As I reflect on my time at Bank Director’s Growing the Bank conference, I can’t shake the fact that many banks across the United States continue to struggle to grow their deposits and/or expand asset bases. What follows is a piece authored by Tim Melvin, a gifted writer who joined us at the Four Seasons outside of Dallas. Tim specializes in value investing and has written numerous articles in various publications on the subject of value investing, the stock market and the world around us. With his permission, I’m sharing his perspectives on our event.

I just returned from the Bank Director 2016 Growing The Bank Conference in Dallas and I have to say it was one of the more interesting meetings I’ve attended this year. This conference covered everything from the 30,000 foot view of the rapidly changing banking industry to the nuts and bolts of day-to-day stuff and I came away with an even deeper appreciation of the industry and the opportunity.

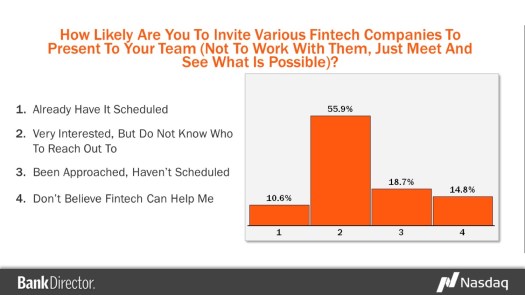

The threats and potential posed by what are commonly known as Fintech companies was heavily featured during the two-day event. Nobody is quite sure if they’re friend or foe yet and there was a lot of wary circling like a road weary cowboy and an unsure Indian trying to decide to break bread together or lock hands on throats. Mobile and cybersecurity were also topics on everyone’s minds, as both are going to play an enormous role in deciding if a bank grows or withers away to obscurity.

Closer Look At Fintech

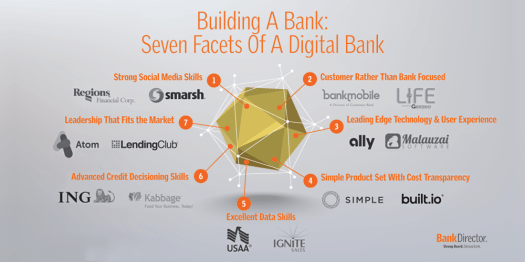

The Fintech discussion was perhaps one of the most interesting of the meeting. While banks may see some of the Fintech lenders like LendingClub (NYSE: LC), Sindeo and On Deck Capital (NYSE:ODNK) are seen as a real threat to traditional lenders, I think we will find that it’s not as big a threat as we might currently think.

The first time we have a credit hiccup or recession, these lenders will find out just how important to success a core deposit-based funding source can be. When markets dry up in the bad times, investors aren’t going to as easy a source of funds as they are in the current benign and yield starved markets. I think what’s far more likely to happen is the technology that allows for high-speed decision making, easier underwriting and razor focused marketing will end up being sold to the banks to improve their offering.

As Steven Hovde of the Hovde Group warned the crowd in Dallas, “Fintech and banks are going to end up marrying up. It’s the only way you are both going to survive. If you think you can do it on your own, you are sadly, sadly mistaken.”

Naomi Snyder, the editor at Bank Director, put a little differently when she wrote an article for the magazines website following the conference: “The tech companies have something many banks lack: innovative products and simple, customer-friendly digital solutions for a changing world. Meanwhile, the banks have some things many of the tech companies lack: actual customers and a more stable funding base.”

Although the fast-moving high tech kids of Fintech and the stuffy old bankers may at first appear to be as mismatched, as James Carville and Mary Matalin may need to find a partnership that has worked out as well as theirs has. They may not initially like each other but they need each other.

Mobile Banking

I think Dave Defazio of Strategycorps scared a lot of community bankers when he talked about the future of mobile banking in his session. He pointed out the tremendous lead that the bigger banks have in this space and the competition from apps like Apple Pay, Venmo and other apps that, to be honest, I’ve never even heard of before but are increasingly popular for managing finances and making payments among the millennial set. For folks who think the ATM and drive-up window are newfangled innovations the world of mobile banking is a bit frightening. What makes it even more frightening is that if you don’t compete well in the mobile space, you won’t retain the next generation of customer. They expect everything to be done on the fly and right now using mobile devices.

The millennial customer is just different. The use their mobile device to pay for their Starbucks (NASDAQ: SBUX), pay their share of the bar tab, watch movies, read books, pay bills and manage their finances. Apparently you can even use an app to collect your boarding pass, as I found out after running out of the bar after the first day to get to the business center and print out my boarding pass exactly 24 hours before takeoff. When I returned and expressed my disappointment at getting a B slotting on Southwest (NYSE: LUV) I was told that I should just get the app to avoid this in the future.

I didn’t even know there was an airplane app, but now I can count myself among the airplane app aristocracy thank to my slightly younger and far more tech savvy friends at Bank Director.

I caught up with Defazio on Tuesday morning and we chatted a bit more about the challenges and opportunities of mobile banking. He told me over coffee, “Banks are not just competing against other banks’ mobile apps, but instead against the very best apps on the planet, apps like Uber to Amazon (NASDAQ: AMZN) to Waze. Customer expectations are very high, and banks must make it their mission to have an app that people can’t live without. Community banks must do a better job of responding to changes in customer behaviors and expectations. The big banks have raced out to a big lead. The time is now for banks to go beyond transactions and do a better job of connecting with their customers’ mobile lifestyles. In particular, I’m seeing the big banks add mobile tools that assist people with their shopping tasks. They know that helping people save a dollar is just as good as helping them make a dollar of interest.”

I chatted with several bankers and the discussion of mobile frankly scares many of them. One banker said if this is the future of banking, then community banking is just dead. I think he overstated the case, but community banks are going to have to aggressively look for partners like Strategycorps to build and offer a much better mobile experience. Those that can’t, or don’t want to, should consider hanging out the for sale sign right away as they simply won’t be competitive in the future. They can probably get a better multiple in a deal now than in a few years when deposits are bleeding out to more mobile sensitive banks at a rapid rate.

Steven Hovde gave a talk on the search for efficiency in the industry. Hovde is an investment banker serving community banks, a majority owner of several smaller banks and is part owner of a real estate development company that borrows from banks so he sees all sides of the industry. He pointed out that the more efficient a bank is the higher then returns on assets and the higher valuation of the institutions stock. Both of these make for happier shareholders. He said the best way to gain efficiency in the banking industry today is to grow the size of the bank.

Right now, we have historically low net interest margins, growing regulatory costs and a huge need to spend money on technology, especially in mobile and cyber security. GDP growth is slow and there are no real signs that it will improve dramatically anytime soon. The loan markets are increasingly competitive and the regulators are focusing on the one area where community banks had an edge, commercial real estate. It really is a “grow or die” world and the majority of banks need to get to $1 billion in assets to quit operating in survival mode and the $5 billion level to thrive in the current economy.

The best way to grow remain via mergers and acquisitions. Hovde told us, “As the regulatory environment becomes increasingly difficult to maneuver for smaller banks, we expect deal activity for smaller institutions to continue as they search for greater efficiencies.” While this is not necessarily great news for bankers running smaller banks, it’s good news for me as bank stock investor and I continue to seek out and buy smaller publicly traded banks.

That’s A Wrap

The Growing the Bank Conference is more of a nuts and bolts, but I walked away with two overriding insights. First banks must look to partner with or even buy the innovative aggressive fintech companies. They cannot compete with them without disastrous consequences so they must partner with them. For their part, most of the fintech competitors need the banks and their large customer base and deposit funding. It may be a shotgun wedding in some cases, but nuptials will be needed for both to survive and thrive.

My second takeaway is that although it sounds like a slogan, “Grow or Die” is a real thing. To thrive in today’s difficult markets, banks need to grow to at least that $5 billion asset level. With the exception of a few niche small town and rural banks the $1 billion asset level is really needed just to be a viable competitor. The best way to grow in a slow growth economy is to buy smaller banks or engage in a merger of equals that increases returns for the ban, as well as shareholders. All of this is good news for us as small bank investors.

The Trade of the decade in community bank stock rolls on.

##

To read more of Tim’s work on Benzinga, click here and to follow Tim on Twitter, his handle is @timmelvin.