For the 699 financial institutions over $1Bn in asset size today, the drive to improve one’s efficiency ratio is a commonly shared goal. In my mind, so too should be developing relationships with “friendly” financial technology (FinTech) companies.

By Al Dominick // @aldominick

Small banks in the United States — namely, the 5,705 institutions under $1Bn in assets* — are shrinking in relevance despite their important role in local economies. At last week’s Bank Audit & Risk Committees Conference in Chicago, Steve Hovde, the CEO of the Hovde Group, cautioned some 260 bankers that the risks facing community banks continue to grow by the day, citing:

- The rapid adoption of costly technologies at bigger banks;

- Declining fee revenue opportunities;

- Competition from credit unions and non-traditional financial services companies;

- Capital (in the sense that larger banks have more access to it);

- An ever-growing regulatory burden; and

- The vulnerability all have when it comes to cyber crime.

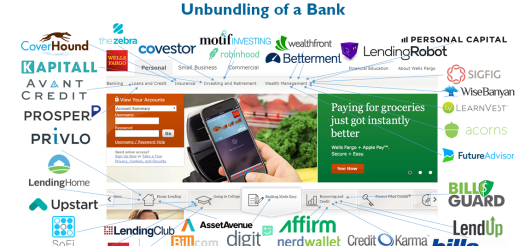

While many community banks focus on survival, new FinTech companies have captured both consumer interest and investor confidence. While some of the largest and most established financial institutions have struck relationships with various technology startups, it occurs to me that there are approximately 650 more banks poised to act — be it by taking the fight back to competitive Fintech companies or collaborating with the friendly ones.

According to John Depman, national leader for KPMG’s regional and community banking practice, “it is critical for community banks to change their focus and to look for new methods, products and services to reach new customer segments to drive growth.” I agree with John, and approach the intersection of the financial technology companies with traditional institutions in the following manner:

For a bank CEO and his/her executive team, knowing who’s a friend, and who’s a potential foe — regardless of size — is hugely important. It is also quite challenging when, as this article in Forbes shows, you consider that FinTech companies are easing payment processes, reducing fraud, saving users money, promoting financial planning and ultimately moving our giant industry forward.

This is a two-sided market in the sense that for a FinTech founder and executive team, identifying those banks open to partnering with, investing in, or acquiring emerging technology companies also presents great challenges, and also real upside. As unregulated competition heats up, bank CEOs and their leadership teams continue to seek ways to not just stay relevant but to stand out. In my opinion, working together benefits both established organizations and those startups trying to navigate the various barriers to enter this highly regulated albeit potentially lucrative industry.

*As of 6/1, the total number of FDIC-insured Institutions equaled 6,404. Within this universe, banks with assets greater than $1Bn totaled 699. Specifically, there are 115 banks with $10Bn+, 76 with $5Bn-$10Bn and 508 with $1Bn – $5Bn.

With said notes in hand, I dove a deeper into each company’s background and offerings, finding all three bring interesting new models and technologies to bear on automating and enhancing the investment research process. So as I’ve done with past posts (

With said notes in hand, I dove a deeper into each company’s background and offerings, finding all three bring interesting new models and technologies to bear on automating and enhancing the investment research process. So as I’ve done with past posts (