When you say the word summit, what do you think of? For me, it is a book; specifically, Let My People Go Surfing by Patagonia’s founder, Yvon Chouinard. I was reminded of Yvon’s thoughts while flying home to DC from last week’s Bank Board Growth & Innovation conference in New Orleans. While there, I had a chance to share time and ideas with some 150 bank CEOs, board members and executives. As most banks wrestle with the concept of banking a generation that doesn’t necessarily see the need for a bank, I think Yvon’s opinion that “how you climb a mountain is more important than reaching the top” is a strong reminder for bankers that the little things really do count with customers today.

By Al Dominick // @aldominick

Having been on numerous airplanes over the last few weeks, I have enjoyed the luxury of time without phone calls and sometimes emails and instant messages. This digital solitude afforded me a chance to really dive into a number of thought-provoking white papers, analyst reports and research pieces. Three, in particular, stand out, for looking ahead to what banking might become, not merely stating the obvious that bankers are being challenged as never before.

The World Retail Banking Report (from Capgemini Financial Services and Efma)

Abstract: Retail banking customers today have more choices than ever before in terms of where, when, and how they bank—making it critical for financial institutions to present options that appeal directly to their customers’ desires and expectations.

Growing the Digital Business / Accenture Mobility Research 2015 (from Accenture)

Abstract: The emergence and adoption of digital technologies has rapidly transformed businesses and industries around the globe. Mobile technologies have been especially impactful, as they have enabled companies to not only streamline their operations, but also engage more effectively with customers and tap into new sources of revenue.

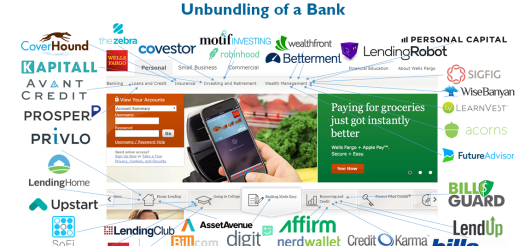

Disrupting Banking: The FinTech Startups That Are Unbundling Wells Fargo, Citi and Bank of America (from CB Insights)

Abstract: Banks run the risk of being out-innovated and may lose their edge not because of their incumbent, large competitors, but because emerging startups inflict upon them a death by a thousand cuts. And because a picture is worth more than 1,000 words:

##

Finally, a welcome to our friends at KBW who just hopped into the Twitter pool yesterday. With so many talented men and women working there, I have no qualms suggesting a follow of their handle – @KBWfinthink (h/t to our Emily McCormick for the heads up)