Bank executives and board members are feeling significant pressures to grow in 2016, according to Bank Director’s 2016 Bank Mergers & Acquisitions Survey, sponsored by Crowe Horwath LLP.

By Al Dominick, President & CEO, Bank Director

Bank CEOs and their boards face some very significant challenges in the years ahead. The sharply increased cost of regulatory compliance might lead some to seek a buyer; others have responded by trying to get bigger through acquisitions in order to spread the costs over a wider base. While transforming a franchise through organic growth is desirable, I continue to see mergers & acquisitions (M&A) remaining the fastest avenue for growth in banking today.

For those who joined us at our annual Acquire or Be Acquired Conference last month, you may recall that Bank Director’s team surveyed 260 chief executive officers, chairmen, independent directors and senior executives of U.S. banks in advance of the conference to examine current attitudes and challenges regarding M&A — and what drives banks to buy and sell. Three points stand out to me:

- Of the respondents who served as a board member or executive of a bank that was sold from 2012 to 2015, a full 55% say they sold because shareholders wanted to cash out.

- Despite concerns that regulatory costs are causing banks to sell, just 27% cite this burden as a primary motivator.

- Credit quality issues are most often cited barriers for banks being able to complete acquisitions.

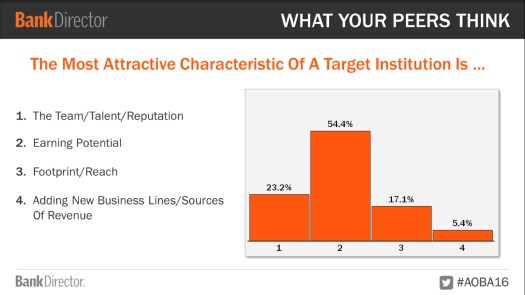

Certainly, “why banks are bought or sold” involves much more than just the numbers making sense. At AOBA, it was made abundantly clear that M&A remains attractive inasmuch as successful transactions improve operating leverage, earnings, efficiency and scale. Moreover, attendees shared during one of our interactive sessions that earnings potential is the most attractive characteristic of an institution they are interested in acquiring.

In his “Buy Or Die In Phoenix: A Recap Of The 2016 Bank Director’s Acquire Or Be Acquired Conference,” Tim Melvin neatly summarizes the conundrum many bank CEOs face today. “Competing against their bigger, better funded rivals is… (a) huge obstacle to growth. The days of opening branches on the other side of town, then the next town over and so on to grow a bank are over.” He concludes by recounting a point made by Steve Hovde, an investment banker we’ve worked with for a number of years: “to thrive, you have to get bigger. To get bigger you probably have to buy and again, if you can’t buy you probably have to sell.”