I am in Seattle to host a peer exchange at the Four Seasons — one focused on emerging legal, regulatory and risk issues facing members of the board of financial institutions. As eager as I am to welcome participants to this beautiful property and city, I have to admit that my attention this morning centers on M&A in the fintech space (thanks to this piece I authored for BankDirector.com). So before the day ramps up, I thought to re-post my perspectives on interesting deals that are reshaping banking.

By Al Dominick // @aldominick

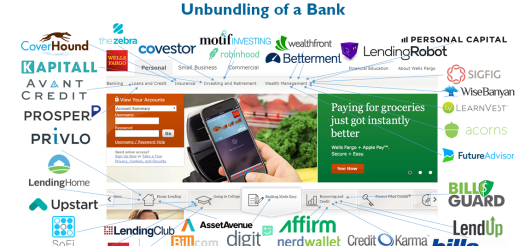

It’s no secret that what has been happening in the fintech space is attracting more attention from the world of banking. It’s hard to ignore the fact that venture capital invested $10 billion in fintech startups in 2014, compared to just $3 billion in 2013, according to an Accenture analysis of CB Insights data. But watching M&A in the fintech space shows that these startups are much more likely to pair with others or get acquired by incumbents than they are to go public with an initial public offering, as noted by bank analyst Tai DiMaio in a KBW podcast recently. “Together, through partnerships, acquisitions or direct investments, you can really have a situation where both parties benefit [the fintech company and the established player],’’ he says. That may lend credence to my initial suspicions that there are more opportunities in fintech for banks than threats to established players and that these startups really need to pair up to be successful.

Take BlackRock’s announcement in August that it will acquire FutureAdvisor, a leading digital wealth management platform with technology-enabled investment advice capabilities (a so-called “robo advisor.”) With some $4.7 trillion in assets under management, BlackRock offers investment management, risk management and advisory services to institutional and retail clients worldwide—so this deal certainly caught my attention.

According to FT Partners, the investment bank that served as exclusive advisor to BlackRock, the combination of FutureAdvisor’s tech-enabled advice capabilities with Blackrock’s investment and risk management solutions “empowers partners to meet the growing demand among consumers to engage with technology to gain insights on their investment portfolios.” This should be seen as a competitive move to traditional institutions, as demand for such information “is particularly strong among the mass-affluent, who account for ~30 percent of investable assets in the U.S.”

Likewise, I am constantly impressed with Capital One Financial Corp., an institution that has very publicly shared its goal of being more of a technology company than a bank. To leapfrog the competition, Capital One is quite upfront in their desire to to deliver new tech-based features faster then any other bank. As our industry changes, the chief financial officer, Rob Alexander, opines that the winners will be the ones that become technology-focused businesses—and not remain old school banking companies. This attitude explains why Capital One was the top performing bank in Bank Director’s Bank Performance Scorecard this year.

Case-in-point, Capital One acquired money management app Level Money earlier this year to help consumers keep track of their spendable cash and savings. Prior to that, it acquired San Francisco-based design firm Adaptive Path “to further improve its user experience with digital.” Over the past three years, the company has also added e-commerce platform AmeriCommerce, digital marketing agency PushPoint, spending tracker Bundle and mobile startup BankOns.

When they aren’t being bought by banks, some tech companies are combining forces instead. Envestnet, a Chicago-based provider of online investment tools, acquired a provider of personal finance tools to banks, Yodlee, in a cash-and-stock transaction that valued Yodlee at about $590 million. By combining wealth management products with personal financial management tools, you see how non-banks are taking steps to stay competitive and gain scale.

Against this backdrop, Prosper Marketplace’s tie up with BillGuard really struck me as compelling. As a leading online marketplace for consumer credit that connects borrowers with investors, Prosper’s acquisition of BillGuard marked the first time an alternative lender is merging with a personal financial management service provider. While the combination of strong lending and financial management services by a non-bank institution is rare, I suspect we will see more deals like this one struck between non-traditional financial players.

There is a pattern I’m seeing when it comes to M&A in the financial space. Banks may get bought for potential earnings and cost savings, in addition to their contributions to the scale of a business. Fintech companies also are bought for scale, but they are mostly bringing in new and innovative ways to meet customers’ needs, as well as top-notch technology platforms. They often offer a more simple and intuitive approach to customer problems. And that is why it’s important to keep an eye on M&A in the fintech space. There may be more opportunity there than threat.

47.607371

-122.339445